Thursday, July 27, 2006

A note on my post on the Brookings Institution paper on reducing poverty from the expenditure side, there is a Barbara Ehrenreich article on Alternet summarizing the article very well.

Tuesday, July 25, 2006

Israeli Deception

Although Israel declared at the start of the bombing of Lebanon that it would not seek to occupy parts of Lebanon, its actions have changed. On the day when Israel "accidentally" bombed the U.N. monitors (accidentally like the U.S. accidentally bombed the Chinese embassy in Belgrade because of 'bad maps'), they also announced that they would occupy parts of Lebanon, although according to the NY Times, less than they occupied for 22 years until 2000. While Israel claimed to occupy it "until an international force could take its place," it is unclear whether the U.S. will allow an internation force to step in. The U.N. has had monitors in southern Lebanon for decades, but these forces have not had the power to enforce a ceasefire and the Bush administration doesn't seem willing to step in and support one. While they officially, according to their vague statements, support a ceasefire, in actuality, they do not support an unconditional ceasefire, but rather one that justifies the Israeli human rights violations (e.g. retribution on civilian populations). Until the Bush administration grows morals and cojones enough to force an immediate, unconditional ceasefire between Israel and Hizbollah, the Bush administration is morally responsible for every civilian death on both sides of the current war. Furthermore, while the Bush administration supported the Lebanese government in expelling the Syrians after the assassination of Rafik Hariri (the right move), they are unwilling to be a neutral broker when Israel has invaded Lebanon. This is callous and unjust and makes the U.S. hypocrites. The Lebanese Army is not fighting Israel and in fact, the Lebanese government that the Bush administration loved so few months ago has become destabilized by Hizbollah's actions. If nothing else, the administration should show some consistency by pushing for an immediate and unconditional ceasefire between Israel and Hizbollah in order to preserve the Lebanese government and then work for a negotiated settlement demilitarizing Hizbollah, expelling Israel from the territory they are occupying and settling the long-standing differences between Israel and Lebanon (primarily over the Israeli-occupied and Lebanese-claimed Sheba Farms area.

Democrats take a step forward

Several Democratic House members have proposed the PROGRESS Act, an act designed to reduce America's energy consumption. Most of what the bill would do would be create regional energy strategies, help fund research into alternative-fuel-powered cars, increase the biofuels infrastructure (which increases the economic viability of biofuels) and promotes public transit and commuter rail. These are laudable goals (and I am proud that my local Rep. Earl Blumenauer (D-OR) is one of the sponsors, along with Steny H. Hoyer (MD), Rep. John Dingell (MI), Rep. Jim Oberstar, Rep. Mark Udall (CO), Rep. Stephanie Herseth

(SD), Rep. Adam Schiff, and Rep. Rush Holt), which will create long-term benefits to the economy while lowering energy consumption. What is missing, unfortunately, are short-term plans to reduce energy use. The two biggest policies that could be implemented immediately to reduce energy use would be to increase the CAFE standards (governing average fuel economy across an entire company's line of automobiles) and to increase the gas tax by $0.50 per gallon. The former would be more politically acceptable, as the sales of large, gas-guzzlers has fallen (although the big automobile manufacturers would fight it), and more equitable in spreading the costs. The latter would be effective (raising gas prices higher would increase pain, particularly for low- and moderate-income people who have not seen wages rise much in the past 5 years), but could be most effectively implemented by targeted tax credits to these income groups and not increasing the tax, but committing to a price floor at $3.00 per gallon. The only major cost of implementation would be to ensure that oil companies do not continue to charge $3.00 per gallon if oil prices fall. Both of these programs will bring much more short-term energy reduction, but also be complementary with the PROGRESS Act by encouraging people to switch to alternative fuels and use public transportation more often instead of driving. While I commend the sponsors of the PROGRESS Act, if they want the act to be more effective in the short-term the two policies I outlined above would be essential.

(SD), Rep. Adam Schiff, and Rep. Rush Holt), which will create long-term benefits to the economy while lowering energy consumption. What is missing, unfortunately, are short-term plans to reduce energy use. The two biggest policies that could be implemented immediately to reduce energy use would be to increase the CAFE standards (governing average fuel economy across an entire company's line of automobiles) and to increase the gas tax by $0.50 per gallon. The former would be more politically acceptable, as the sales of large, gas-guzzlers has fallen (although the big automobile manufacturers would fight it), and more equitable in spreading the costs. The latter would be effective (raising gas prices higher would increase pain, particularly for low- and moderate-income people who have not seen wages rise much in the past 5 years), but could be most effectively implemented by targeted tax credits to these income groups and not increasing the tax, but committing to a price floor at $3.00 per gallon. The only major cost of implementation would be to ensure that oil companies do not continue to charge $3.00 per gallon if oil prices fall. Both of these programs will bring much more short-term energy reduction, but also be complementary with the PROGRESS Act by encouraging people to switch to alternative fuels and use public transportation more often instead of driving. While I commend the sponsors of the PROGRESS Act, if they want the act to be more effective in the short-term the two policies I outlined above would be essential.

Friday, July 21, 2006

Union rights in the crosshairs

The Economic Policy Institute has a paper, "Supervisor in name only" that highlights the Kentucky River cases, which, depending on the outcome, could result in millions of workers with no responsibility for hiring, firing and disciplinary actions being classified as supervisors and therefore "be denied the right to form unions or engage in collective bargaining". The case is a test of how anti-labor the National Labor Relations Board (NLRB) has become after 6 years of Bush. Examples of some of the occupations where the ruling has the power to affect includes Registered Nurses, Cooks, Secretaries, and even Chemistry Teachers, hardly jobs expected to have significant supervisory roles as they are currently thought of under the National Labor Relations Act. In fact, the act defines supervisors as:

This case could help put the nail in the coffin of organized labor, something the Republican party and the business interests which fund it have dreamed about for a long time. If the NLRB has any decency and respect for labor unions and the fundamental right of workers to unionize, it will uphold the rights of nurses, chemistry teachers, cooks and many other non-supervisory workers to unionize and overturn a bogus attempt by anti-labor business interests to subvert the intent of the National Labor Relations Act.

Any individual having authority, in the interest of the employer, to hire, transfer, suspend, lay off, recall, promote, discharge, assign, reward, or discipline other employees, or responsibly to direct them, or to adjust their grievances, or effectively to recommend such action, if in connection with the foregoing the exercise of such authority is not of a merely routine or clerical nature, but requires the use of independent judgment. (29 USC 152 (11))

This case could help put the nail in the coffin of organized labor, something the Republican party and the business interests which fund it have dreamed about for a long time. If the NLRB has any decency and respect for labor unions and the fundamental right of workers to unionize, it will uphold the rights of nurses, chemistry teachers, cooks and many other non-supervisory workers to unionize and overturn a bogus attempt by anti-labor business interests to subvert the intent of the National Labor Relations Act.

Wednesday, July 19, 2006

Reducing Poverty on the Household Expenditure Side

There is a great Brookings Institution report by Matt Fellowes, "From Poverty, Opportunity," that highlights many ways in which poverty can be reduced by helping even out the costs faced by low-income families and individuals with higher-income families and individuals. The report starts by identifying the key areas on the expenditure side where those with low-incomes are charged more than those with higher incomes: morgages and house insurance, car payments and insurance, short-term lending, appliance purchases and groceries. He systimatically goes through each area detailing how lower-income people are charged more than higher-income people, for example, by the prevalence of payday lenders in lower-income areas, whereas higher-income people are more likely to use a bank. Furthermore, much of the pricing difference in the insurance market is due to murky and non-existent insurance disclosure and reporting requirements. Beyond these, there are five areas where local policymakers can help reduce costs to lower-income people:

- Alert business of opportunity - There is a tremendous area for companies to add consumers if they enter low-income neighborhoods. Many have been hesitant because of higher actual and perceived risks. However, there are many ways in which local governments can facilitate their entry, particularly by restricting the growth of the exploitative loan/rent-to-own companies in lower-income neighborhoods

- Eliminate unscrupulous businesses and high-fee/interest rate lending institutions - Many state and local governments have capped the rates of interest and fees payday loan, auto title loan and check-cashing companies can charge. Other governments have either banned them entirely or issued a moratorium on issuing licenses for these companies. With regards to rent-to-own stores, many states and localities have restricted the interest and fees to a percentage of the total worth of the item being purchased.

- Encourage companies to develop products designed for low-income consumers that undercut payday loan institutions - With their tremendous financial resources, if banks open branches in low-income neighborhoods, they could increase their profitability by offering services that compete and undercut the existing payday loan companies and therefore reduce their presence and increase the experience of lower-income consumers with mainstream financial institutions, as well as saving consumers money.

- Increase grocery store sizes in lower-income neighborhoods - The data show that smaller grocery stores, which are more likely to predominate lower-income neighborhoods, charge higher prices than larger stores. Often zoning regulations restricts their presence. In most areas, consumers want larger stores, but not supercenters like Wal-Mart. Therefore, policymakers can alter zoning regulations to allow larger grocery stores, while still restricting or preventing the growth of supercenters in these areas.

- Assist low-income consumers in financial education and price comparison - The internet is a powerful tool for price comparison and the spread of information like financial education, both of which would allow lower-income consumers to save money on the necessities. If the internet is made available in lower-income areas for free with publicity about the areas in which consumers can compare prices and get financial education, the positive impact would be quick and meaningful.

Executive Power Increased - The New Line-Item Veto

The Center on Budget and Policy Priorities has a new report analyzing the effect of a proposed new line-item veto that would increase executive power (while fixing the aspects of the 1996 line-item veto that caused it to be struck down in the courts). The proposed bill would allow the president to send four veto packages back to Congress to be voted upon with no amendments or filibusters. Since there are 11 appropriation bills passed each year, each veto packages would contain items from a number of spending bills. The president would have one year from when the bills are passed to veto line-items. Even if the Congress over-ruled the president's veto, the president could withhold funding for up to 45 days. If the veto was made in late August, for example, and the Congress voted upon the veto immediately (there is a 13 day maximum window from the veto until the vote), the President could withhold funds until after September 30, the end of the fiscal year, which would cancel the appropriations even though the Congress struck down the veto. Because the president has a year to make a veto package, he could use it to blackmail legislators on many unrelated issues by promising not to veto pork barrel legislation of a Congressman if he votes the president's way on another bill. One need only to recall the Congress holding the highway bill vote until after the vote on the Central American Free Trade Area (CAFTA) in order to pressure wavering Congressmen to vote the Administration's way. Furthermore, tax cuts are treated differently than spending. Spending can be vetoed in all cases, cannot be partially reduced and automatically reverts to deficit reduction. Tax cuts can only be vetoed if they are 'limited' in scope, defined by the Senate bill as applying to less than 100 people and by the House bill as applying to one individual or company. All other tax cuts are exempt from a veto and the determination of whether tax cuts are 'limited' is up to the Congress to decide. If the line-item veto is passed in this form, the executive branch would gain an immense amount of political leverage over the legislative branch, a point made by conservative columnist George Will (quoted in the CBPP report), "The line-item veto's primary effect might be political, and inimical to a core conservative value. It would aggravate an imbalance in our constitutional system that has been growing for seven decades: the expansion of executive power at the expense of the legislature." Furthermore, as Norm Ornstein of the conservative American Enterprise Institute notes (again, quoted in the CBPP report) , "The larger reality is that this gives the president a great additional mischief-making capability, to pluck out items to punish lawmakers he doesn’t like, or to threaten individual lawmakers to get votes on other things, without having any noticeable impact on budget growth or restraint." The new line-item veto hurts the constitutional separation of powers, doesn't lead to spending restraint, particularly when pork projects are involved, and favors tax cuts over spending.

Tracking Tax Incentive Effectiveness, continued

As I have looked through the database in Illinois, I have come across two possible problems with the system, one for which there is an easy remedy and one which appears somewhat intractable. The first is that companies are able to forecast their future employment increases. For example, looking at the first entry for Advance International, Inc., the company forecasted an increase in employment of 150 jobs but only 3 materialized (and at only $14,040 per year salary). In the final section of the report (available in pdf), the company reports the number of jobs it expects to create over the next year. For Advance International, Inc., the company expects to start 147 new employees on June 1, 2006 (at $14,040 average salary per year), exactly the amount needed to make up for their deficiency from the projected employment creation upon signing the agreement to receive tax credits. This allows companies to delay accountability by forecasting employment growth up to their "quota" for the next year. However, as long as the database remains available, the public can keep informed about the compliance of various companies with their agreements. In addition, to control the incentive to produce just enough employment to comply with agreements for awards, the governments may be able to extract higher promised employment increases in new tax credit agreements. The other problem, however, is not so easily solved. The problem is that state-by-state databases do nothing to diminish the inter-state competition for jobs and the tax credit shopping behavior of companies. Unless either the databases are shared between states before awarding new tax credits for companies (which could use threats of withholding future tax credits unless jobs are created), companies can still pit states against each other in the competition for jobs. States still need to not only account for whether jobs are moved within the state (like the Illinois system does), they need to assess whether the jobs are actually new jobs or are just jobs transferred from another state. This is a difficult problem because state government's primary goal is to demonstrate that they are bringing jobs into the state and the movement of jobs out of other states into the home state are not judged differently than newly created employment. $1 used to create a new job is far better money spent than $1 spent moving a job from Ohio to Oregon for the national economy. State tax credits should be focused on creating new employment, not moving jobs from one state to another. The state-to-state movement via tax cuts will only increase the power of companies to lead a race-to-the-bottom in terms of state taxes and leave all the states in a worse budgetary state. The best way to deal with this would be to not only ask whether the employment created is the result of moving jobs within a state, but also to require reporting on whether the jobs created are moving in from other states, rather than being created. The Illinois system benefits Illinois, but may harm Maryland. For the system to benefit America as a whole, it must also have a national reporting focus.

Tuesday, July 18, 2006

Tracking Tax Incentives Effectiveness

The Oregon Center for Public Policy (OCPP) has a fascinating article (CenterPoints, July 2006) advocating the creation of a database that details the tax breaks given to companies, the job commitments the companies offer and the performance towards meeting these commitments, including the salary of the positions created. This type of database has already been created in Illinois and is called the State of Illinois Corporate Accountability database. For example, if you look the 2005 progress report for ISG Steel Group, the database shows that the company received an Enterprise Zone Expanded M&E Sales Tax Exemption for $158,364 and a Large Business Development Assistance Program award for $500,000 with the promise of creating 200 Technician jobs paying on average $38,556 per year. The report shows that not only were more Technician jobs (447) created, they were slightly higher paying on average ($39,995 per year), more Managerial, Administrative and Specialist jobs were created as well. While in this case, the company exceeded the projections, the database can also show when companies fall behind their commitments and allow the public the knowledge of this in detail. It is an excellent way to bring about corporate accountability for companies receiving tax breaks as well as accountability to the politicians responsible for giving tax credits. It is a way to use the internet to increase government accountability and should be adopted by every state.

Treasury Department Mid-Session Review Casts Doubt on Bush Claims that Tax Cuts Pay for Themselves

“Some in Washington say we had to choose

between cutting taxes and cutting the deficit….Today’s numbers show that that

was a false choice. The economic growth fueled by tax relief has helped send

our tax revenues soaring. That’s what has happened.” --George W. Bush, July 11, 2006

While Bush claims that tax cuts have 'paid for themselves', the Center on Budget and Policy Priorities (CBPP) claims otherwise. Using projections from the Office of Management & Budget's mid-session review of the 2007, they point out that the increased revenue gained from the tax cuts under the most optimistic economic forecasts would be $29 billion. While this is a positive benefit from tax cuts, it is far short of the Joint Committee on Taxation's estimate for the cost of making the tax cuts permanent (not counting the costs already incurred or the costs of fixing the Alternative Minimum Tax): $314 billion. The Bush administration believes that they can issue hollow rhetoric that even ignores their own estimates of the effect of tax cuts. In fact, I believe that the CBPP estimates of tax revenue increases is overstated. Their estimate assumes that of the $146 billion increase in GDP in 2016, 20 percent of that will be collected in taxes. According to the non-partisan Congressional Budget Office's (CBO) latest budget projections between 2007 and 2016 (pdf), federal government revenues will never reach 20 percent of GDP, ranging from a low of 17.5 percent in 2005 (actual data) to a projected high of 19.7 percent in 2016 with an average over the period of 18.9 percent. This is even probably an overestimate because CBO estimates do not include any estimates of cyclical economic fluctuations, which will probably dampen the levels of revenue (revenue falls when the economy slows or contracts).

between cutting taxes and cutting the deficit….Today’s numbers show that that

was a false choice. The economic growth fueled by tax relief has helped send

our tax revenues soaring. That’s what has happened.” --George W. Bush, July 11, 2006

While Bush claims that tax cuts have 'paid for themselves', the Center on Budget and Policy Priorities (CBPP) claims otherwise. Using projections from the Office of Management & Budget's mid-session review of the 2007, they point out that the increased revenue gained from the tax cuts under the most optimistic economic forecasts would be $29 billion. While this is a positive benefit from tax cuts, it is far short of the Joint Committee on Taxation's estimate for the cost of making the tax cuts permanent (not counting the costs already incurred or the costs of fixing the Alternative Minimum Tax): $314 billion. The Bush administration believes that they can issue hollow rhetoric that even ignores their own estimates of the effect of tax cuts. In fact, I believe that the CBPP estimates of tax revenue increases is overstated. Their estimate assumes that of the $146 billion increase in GDP in 2016, 20 percent of that will be collected in taxes. According to the non-partisan Congressional Budget Office's (CBO) latest budget projections between 2007 and 2016 (pdf), federal government revenues will never reach 20 percent of GDP, ranging from a low of 17.5 percent in 2005 (actual data) to a projected high of 19.7 percent in 2016 with an average over the period of 18.9 percent. This is even probably an overestimate because CBO estimates do not include any estimates of cyclical economic fluctuations, which will probably dampen the levels of revenue (revenue falls when the economy slows or contracts).

Bush blocked review of NSA wiretapping program

"The president decided that protecting the secrecy and security of the program requires that a strict limit be placed on the number of persons granted access to information about the program for non-operational reasons," --Alberto Gonzales, US Attorney General in Senate Judiary Committee testimony, July 18, 2006.

The revelation by AG Gonzales that Bush blocked the Office of Professional Responsibility (OPR) from investigating whether the NSA wiretapping program was legal for 'non-operational reasons' raises red flags for me. With the AG is not even claiming that the program was kept secret in order to protect its operations, I become even more suspicious that the administration knew the program was of dubious legality and therefore, in order to protect the President and the Republican Party from scrutiny that would arise upon the revalation of the program's existence, they limited knowledge of the program. Apparently, their fear was that the more exposure the program had among those who might question the necessity or legality of such a warrentless wiretapping program, the more likely it would be subject eventually to Congressional and judicial oversight. Of course, it could have just been the non-operational reason that the administration prefers to keep secrets and it is, in fact, their default.

The revelation by AG Gonzales that Bush blocked the Office of Professional Responsibility (OPR) from investigating whether the NSA wiretapping program was legal for 'non-operational reasons' raises red flags for me. With the AG is not even claiming that the program was kept secret in order to protect its operations, I become even more suspicious that the administration knew the program was of dubious legality and therefore, in order to protect the President and the Republican Party from scrutiny that would arise upon the revalation of the program's existence, they limited knowledge of the program. Apparently, their fear was that the more exposure the program had among those who might question the necessity or legality of such a warrentless wiretapping program, the more likely it would be subject eventually to Congressional and judicial oversight. Of course, it could have just been the non-operational reason that the administration prefers to keep secrets and it is, in fact, their default.

Condi Rice Stalls

Reuters reported a few hours ago that Condoleeza Rice had not made plans to travel to the Middle East, or even out of the country, until at least Friday. Reuters reports that:

Further proof that the Administration has no handle on how to deal with the renewed fighting in the Middle East except to give Israel the thumbs up and blame Iran and Syria. In other related news, the wack-jobs at the Weekly Standard and Bill Kristol want the U.S. to get involved against Iran, Syria and Hezbollah

U.N. sources confirmed Rice would meet Annan on Thursday, but in Washington, State Department officials said no final decision has been made on the timing or itinerary of any foreign travel she might make. An aide to Rice said she would not be making any international travel on Friday.

Further proof that the Administration has no handle on how to deal with the renewed fighting in the Middle East except to give Israel the thumbs up and blame Iran and Syria. In other related news, the wack-jobs at the Weekly Standard and Bill Kristol want the U.S. to get involved against Iran, Syria and Hezbollah

Monday, July 17, 2006

Middle East Disaster and Bush's Ineptitude

Since Israel has started its excessive retribution against Lebanon (2 Israeli soldiers captured and 8 killed, versus 210 Lebanese killed, all but 14 of them civilians), it has highlighted the ineptitude of the Bush administration's foreign policy. With the Bush administration creating a quagmire in Iraq unnecessarily and entirely ignoring the Israeli-Palestinian conflict apart from a few thumbs up to Sharon (and now Olmert) for some violations of U.N. resolutions and the laws of war, the current situation was all but inevitable. Initially, Condoleeza Rice, US Secretary of State, frowned upon travelling to the Middle East to engage in shuttle diplomacy (defined as "the use of a third party to serve as an intermediary or mediator between two parties who do not talk directly").

Instead, the Bush administration was more focused on brunting the international furore created by Israeli over-reaction. On 'This Week with George Stephanopolous,' Rice was focused on the "root causes" of the violence:

She seems unaware that Israel has begun widespread bombing of Lebanon, with a focus on civilian infrastructure like the Beiruit airport, government buildings and power plants along with "ports, roads, bridges, factories and petrol stations". This is not the time to deal with the root causes, rather it is a time for an emergency intervention aimed at ending the fighting. Until the Israeli bombing and Hezbollah rocket attacks end, there will be no way to deal with the root causes. The root causes should have been dealt with over the past 5 and a half years of the Bush administration when it was more focused on drawing America into an unnecessary war with Iraq. However, Rice tries to portray Bush as being involved in the crisis. According to Rice on 'This Week':

In essence, the initial reaction of the Bush administration to Israeli bombing of Lebanon was to unconditionally defend the move. Only in the face of continued European pressure has Bush finally agreed that maybe Rice should be sent and maybe there should be a ceasefire. Even on the latter point, however, he was deferential to the Israeli government frowning on the idea of a multilateral force to enforce a cease fire. It is absolutely despicable that a U.S. president can be so supportive of one side's violence in the Middle East. While past presidents have always favored the Israeli side, they were careful to do so while still maintaining an officially neutral position favoring negotiations and an end to the violence. Bush breaks that tradition by officially supporting Israel and opposing moves meant to end the violence and bring the two sides towards a diplomatic rather than military solution.

Instead, the Bush administration was more focused on brunting the international furore created by Israeli over-reaction. On 'This Week with George Stephanopolous,' Rice was focused on the "root causes" of the violence:

"I'm certainly willing to play whatever role I'm needed to play," she [Rice] said. "We have to go at the root cause. It's fine to have a cessation of violence. We want to have a cessation of violence. We're worried about the escalating casualties on all sides, but unless we go to the fundamentals here, we're going to continue to have these spikes of violence in the Middle East as we have had for the past 30 years."

She seems unaware that Israel has begun widespread bombing of Lebanon, with a focus on civilian infrastructure like the Beiruit airport, government buildings and power plants along with "ports, roads, bridges, factories and petrol stations". This is not the time to deal with the root causes, rather it is a time for an emergency intervention aimed at ending the fighting. Until the Israeli bombing and Hezbollah rocket attacks end, there will be no way to deal with the root causes. The root causes should have been dealt with over the past 5 and a half years of the Bush administration when it was more focused on drawing America into an unnecessary war with Iraq. However, Rice tries to portray Bush as being involved in the crisis. According to Rice on 'This Week':

[She] described President Bush as "deeply engaged" in the Middle East crisis. "The president has spoke out clearly about Israel's right to defend itself," she said.

In essence, the initial reaction of the Bush administration to Israeli bombing of Lebanon was to unconditionally defend the move. Only in the face of continued European pressure has Bush finally agreed that maybe Rice should be sent and maybe there should be a ceasefire. Even on the latter point, however, he was deferential to the Israeli government frowning on the idea of a multilateral force to enforce a cease fire. It is absolutely despicable that a U.S. president can be so supportive of one side's violence in the Middle East. While past presidents have always favored the Israeli side, they were careful to do so while still maintaining an officially neutral position favoring negotiations and an end to the violence. Bush breaks that tradition by officially supporting Israel and opposing moves meant to end the violence and bring the two sides towards a diplomatic rather than military solution.

Saturday, July 08, 2006

Dismal Jobs Numbers

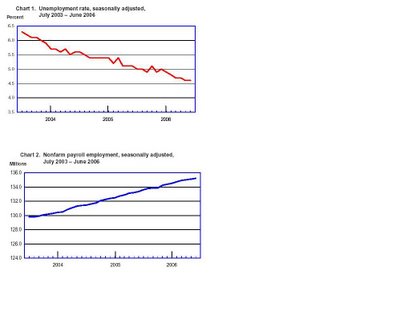

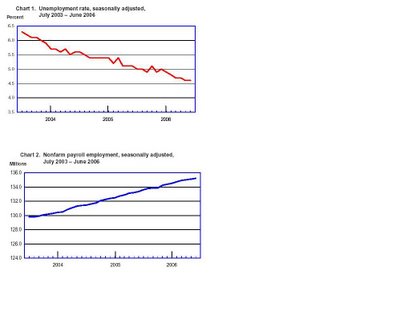

The Bureau of Labor Statistics (BLS) released its monthly employment numbers today showing that only 121,000 jobs were added to the workforce in June. This is short of the 150,000-200,000 jobs that need to be created in order to keep up with growth of the labor force. However, the report starts off with two positive graphs showing unemployment dropping over the past 36 months while employment grows.

I was curious to see whether, using these 3 years (which were the best of the Bush presidency in terms of employment), employment and unemployment met the replacement rate (the rate at which jobs need to be created to keep pace with labor force growth). They were not, and the linked table (HTML) demonstrates that. Below I will discuss possible problems interpreting my analysis, but the fact is that the past 3 years have seen meager employment growth at the same time as the unemployment rate has failed to fall as much as possible. Had the economy grown by 175,000 jobs per month, the average value thought to be needed to keep up with population growth, the unemployment rate should be 3.5 percent and there should be an extra 1.28 million jobs. Even with a more modest assumption that the economy needs to generate 150,000 jobs per month to keep up with labor force growth, the unemployment rate would be 4.3 percent and there would be an extra 380,000 jobs. This is a 0.3 percent lower unemployment rate!

Now for the caveats. The main caveat is that my numbers will underestimate the unemployment level compared to the actual level. This is because I simply take the employment numbers in June 2003 and add 150,000 to it. If I had the capability, I would need to take into account that when employment growth is higher, the workforce will expand at a faster rate than when growth is lower. Because the extrapolations I measure are higher (175,000 and 150,000 per month versus 140,306), my values for employment are going to be high relative to the total labor force, for which I use the actual data. For example, my calculations suppose that with 175,000 jobs being created each month in the July 2003-June 2006 time frame, the unemployment rate will drop to 3.5 percent. In reality, with job growth of 175,000 workers per month, more job seekers are going to be looking for work and so the total labor force will increase more than it actually did, which would probably raise the unemployment rate to between 3.8 and 4.0 percent. However, the gains in total employment would make more people better off, and therefore increase the overall well-being. Therefore,

I think my estimates are still valid at showing that the economic policies which created the actual economic performance are sub-optimal to what is possible (and what actually occurred under the previous Democratic presidency). The rest of my caveats are more for the geeks and there isn't much that would interest the non-geeks and skipping it will not prejudice the overall conclusions. In order to calculate this, I used the seasonally adjusted private sector, non-farm employment number, the standard used by the BLS, calculated from the survey of enterprises (the Current

Employment Statistics survey, or CES). To calculate unemployment, I used the household survey (the Current Population Survey, or CPS). Because of the way these surveys are conducted, they sometimes differ on the level of unemployment, but the CPS is more frequently used. Because I had the private, non-farm employment numbers, I used the unemployment rate to calculate the private, non-farm unemployment numbers and therefore the total labor force (which is the employed plus unemployed populations).

The main thing to be gained by looking deeper by comparing the potential employment numbers with the actual numbers is that, whatever the political spin, the economy has underperformed over the past 3 years. Undoubtably, the picture would look far more bleak if the entire period from January 2001 to June 2006 were used. This compounded with the stagnation of wages for most workers (the minimum wage is at the lowest level in real terms since 1955) that the economic management of the Bush Administration begins to look quite dismal, at least for those who work for a living.

I was curious to see whether, using these 3 years (which were the best of the Bush presidency in terms of employment), employment and unemployment met the replacement rate (the rate at which jobs need to be created to keep pace with labor force growth). They were not, and the linked table (HTML) demonstrates that. Below I will discuss possible problems interpreting my analysis, but the fact is that the past 3 years have seen meager employment growth at the same time as the unemployment rate has failed to fall as much as possible. Had the economy grown by 175,000 jobs per month, the average value thought to be needed to keep up with population growth, the unemployment rate should be 3.5 percent and there should be an extra 1.28 million jobs. Even with a more modest assumption that the economy needs to generate 150,000 jobs per month to keep up with labor force growth, the unemployment rate would be 4.3 percent and there would be an extra 380,000 jobs. This is a 0.3 percent lower unemployment rate!

Now for the caveats. The main caveat is that my numbers will underestimate the unemployment level compared to the actual level. This is because I simply take the employment numbers in June 2003 and add 150,000 to it. If I had the capability, I would need to take into account that when employment growth is higher, the workforce will expand at a faster rate than when growth is lower. Because the extrapolations I measure are higher (175,000 and 150,000 per month versus 140,306), my values for employment are going to be high relative to the total labor force, for which I use the actual data. For example, my calculations suppose that with 175,000 jobs being created each month in the July 2003-June 2006 time frame, the unemployment rate will drop to 3.5 percent. In reality, with job growth of 175,000 workers per month, more job seekers are going to be looking for work and so the total labor force will increase more than it actually did, which would probably raise the unemployment rate to between 3.8 and 4.0 percent. However, the gains in total employment would make more people better off, and therefore increase the overall well-being. Therefore,

I think my estimates are still valid at showing that the economic policies which created the actual economic performance are sub-optimal to what is possible (and what actually occurred under the previous Democratic presidency). The rest of my caveats are more for the geeks and there isn't much that would interest the non-geeks and skipping it will not prejudice the overall conclusions. In order to calculate this, I used the seasonally adjusted private sector, non-farm employment number, the standard used by the BLS, calculated from the survey of enterprises (the Current

Employment Statistics survey, or CES). To calculate unemployment, I used the household survey (the Current Population Survey, or CPS). Because of the way these surveys are conducted, they sometimes differ on the level of unemployment, but the CPS is more frequently used. Because I had the private, non-farm employment numbers, I used the unemployment rate to calculate the private, non-farm unemployment numbers and therefore the total labor force (which is the employed plus unemployed populations).

The main thing to be gained by looking deeper by comparing the potential employment numbers with the actual numbers is that, whatever the political spin, the economy has underperformed over the past 3 years. Undoubtably, the picture would look far more bleak if the entire period from January 2001 to June 2006 were used. This compounded with the stagnation of wages for most workers (the minimum wage is at the lowest level in real terms since 1955) that the economic management of the Bush Administration begins to look quite dismal, at least for those who work for a living.

Monday, July 03, 2006

Whales 1, U.S. Navy & DoD 0

A court has overruled the Department of Defense (DoD) and placed an injunction prohibiting the use of high-powered sonar by the Navy in their "war games" near Hawaii because of the damage it would cause to marine life, particularly whales, in the area. This is a positive ruling because the DoD had exempted the Navy from rules designed to protect marine life from the use of this sonar. It is another ruling against the executive branch's belief that it is free from all Congressional laws and judicial opinion.